Net banking makes it possible to utilize a range of banking services online from the comfort of your space. Karnataka Bank’s net banking facility, known as MoneyClick, is similarly extending convenient services for their customers.

The Karnataka Bank online banking service is available for all groups, including personal services to retail, commercial, and corporate banking. They have tailored the net banking portal to cater to the different needs of the users, from using electronic payment systems to carrying out financial management.

If you wish to learn about the net banking service of Karnataka Bank further, the registration process, how to log in, change passwords, and transfer funds using the portal, keep reading our detailed article.

Karnataka Bank Limited is a top-listed scheduled Commercial Bank in India, and it was established on February 18th, 1924. It is headquartered in the Mangalore city of Karnataka. It has over 858 branches spread around twenty-two states and two Union Territories.

They deliver high-quality services for their trusted customers. Their net banking service is called MoneyClick, and it is available throughout the year and around the clock. It provides a secure, user-friendly environment for the convenience of the customers.

You can redeem various services like fund transfer, balance inquiry, online account opening, bill payments, online trading, shopping, etc., with MoneyClick. The net banking facility eliminates the need to stand in long queues and go through lengthy procedures in the bank.

If you are looking forward to using Karnataka Bank net banking, there are certain procedures you need to be aware of. Read the information mentioned ahead.

Karnataka bank is dedicated to providing a seamless experience for their customers, and they have an efficient customer care unit that provides assistance throughout working hours. In case of any doubt, inconvenience or difficulty, you can approach the customer care unit through Twitter or through the official email ID and contact number.

The contact number of the Karnataka Bank customer care unit is 18004251444, and the email ID is ‘[email protected]’. You can also seek help from the official website of Karnataka Bank and look for the required information.

The Karnataka Bank IFSC code is mandatory to send money using the online fund transaction methods. Hence, you need to be aware of it for depositing money into an account with the bank. The IFSC code is a distinct eleven-digit code comprising alphanumeric digits.

It aids in the identification of the bank as well as enables you to carry out transactions through electronic payment systems like NEFT, RTGS, and IMPS. This code is generated under the guidance of RBI and is unique for every branch of a bank based in India. The eleven-digit code is present in the format ‘ABCD0123456’.

For example, the IFSC code of the Mangalore branch is KARB0000471. One can break this code down into three parts, where the initial four digits (KARB) represent the name of your bank, the fifth digit is a zero (0), and the last six digits (000471) represent the branch code.

Among the various ways to find the IFSC code, the top option is the online website named ‘Find Your Bank.’ You can quickly obtain the IFSC code through their website by following the simple procedure mentioned ahead:

Once done, click enter, and you will find the IFSC code in your search results. Apart from the website, you can also use the Find Your Bank mobile app. It is crafted to provide a multitude of services and to quickly get a hold of the banking information like the IFSC, MICR as well as SWIFT code.

You can register for the Karnataka Bank net banking through both online and offline modes. To register offline, you need to visit the bank in person to obtain the registration form or download it through the website.

Fill in the required details like account details, card information, and personal information. Once filled, you can submit the form to your branch. The bank will send the user id and password through courier to the address mentioned in your application.

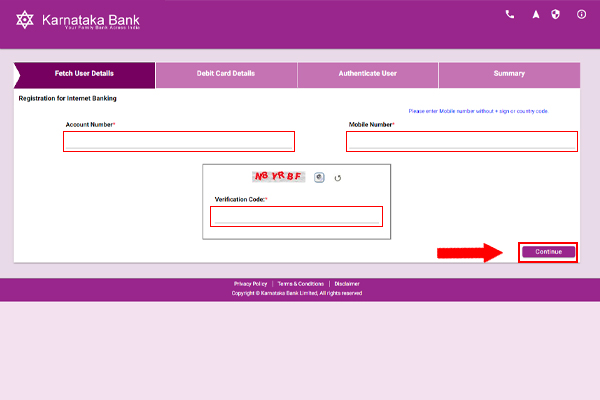

You can use the provided credentials to use the net banking services. To register with Karnataka Bank online, follow the given steps:

After you register for the net banking service, you can log in using the user ID and password provided to you. The Karnataka Bank login process is relatively easy. Simply follow the given steps:

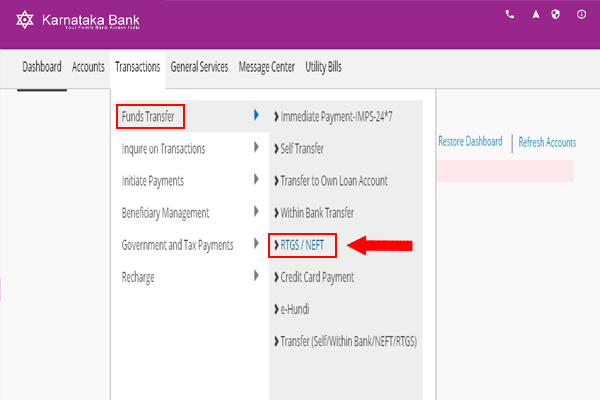

To transfer money through the net banking service of Karnataka Bank, you can use various fund transfer options like NEFT, RTGS, and IMPS. You will require the account details as well as some essential credentials like the Karnataka Bank IFSC code.

Some crucial details are necessary for online fund transfer are mentioned ahead:

You can use all the above data to complete successful transactions using net banking. Transactions through online services can be made anytime and anywhere.

To send funds to an account within the bank, select the appropriate option for fund transfer. Then, you just need to enter the account details of your bank account as well as that of the beneficiary. Then confirm the details entered and verify using the OTP provided. You can send money instantly this way.

To transfer money from Karnataka Bank to other banks, you need to similarly add the details of the beneficiary as well as your bank account. After adding the beneficiary, you can enter the transaction details.

Proceed by authenticating the process using the verification code sent to you. The transaction would be completed successfully.

There could be chances that you forget your Karnataka Bank net banking password, or you might want to change it. If something similar happens, you can follow a simple procedure to reset the password. Just follow the given steps:

You can activate the internet banking service of Karnataka Bank through both offline and online methods. To register offline, you can obtain the registration form from the branch, fill in the required details and submit it accordingly.

You will get a user ID and password for Karnataka Bank net banking once you register for the net banking service. As mentioned, you can register through offline or online methods. Once the service gets activated, you will be given your user ID, and you can set the desired password.

The user ID refers to the unique identity of a user that the bank provides to log in to the net banking service. Your user ID can be acquired from the bank once you are registered for the net banking facility of Karnataka Bank.

The Karnataka Bank statement can be downloaded from the website. However, it is password protected. The password for the document is usually the date of birth mentioned on your bank details or the customer ID mentioned on the bank passbook.

To check the Karnataka Bank account balance, you can give a missed call to the balance inquiry number 1800-425-1445 from the registered mobile number, after which the statement would be sent to your number in an SMS.

Sathishkumar Varatharajan is an Internet Marketer, a social Media strategist and a business consultant. He has launched FindYourBank.in to provide IFSC, Bank Address, MICR Code and other details for the banks in India to all the Indian people.